In the context of consumer retention and behavioural analytics, loyalty programmes serve as a sophisticated mechanism for incentivising repeat engagement. Operating across diverse sectors such as retail, travel, and financial services, these initiatives are underpinned by data-driven structures that translate customer actions into quantifiable rewards. This section provides a foundational overview of how such programmes are architected, the underlying technologies they utilise, and the psychological principles they harness to sustain long-term customer affiliation.

In the modern marketplace, loyalty programmes act as a powerful tool for brands aiming to build long-term relationships with their customers. These schemes offer incentives - typically in the form of points, miles, or credits - earned through regular engagement or purchases. Over time, these rewards can be redeemed for discounts, gifts, upgrades, or even exclusive experiences, depending on the specific design of the programme. It's a mutually beneficial arrangement where consumers gain extra value, while businesses encourage repeat transactions.

At their core, loyalty programmes track customer behaviour. By monitoring what you buy, how often you interact, and where you engage, companies gather insights to tailor future offers. Although it might sound transactional, the most successful programmes create emotional bonds. Think about how you feel when greeted by name at your favourite café, and you're handed a free drink for your tenth visit - it fosters a sense of belonging and appreciation.

Surprisingly, many loyalty programmes operate using complex algorithms that assign value based on dynamic factors. Whether you’re collecting Avios on flights, supermarket points, or cashback on fuel, the underlying systems adjust earnings and redemptions based on time, location, demand, and your user profile. So, the next time you swipe your loyalty card, remember: there’s a clever engine calculating your value.

Loyalty schemes aren't one-size-fits-all; they come in several distinctive forms. Points-based systems are perhaps the most familiar - spend money, earn points, and redeem for goodies. Airlines, hotels, and grocery chains often adopt this model. Tiered programmes, on the other hand, reward customers differently based on their status level. Climb the ranks, and you unlock superior perks such as faster service, priority access, or exclusive invitations.

Some businesses go a step further with subscription-based loyalty. For a monthly or annual fee, you gain immediate access to premium features or accelerated benefits. Then there’s gamification, where brands turn earning into a playful experience. Completing challenges, spinning wheels, or collecting digital badges keeps users engaged and returning for more.

Coalition programmes involve multiple companies collaborating under a single rewards umbrella. These are particularly appealing if you’re a varied spender. Earn at the petrol station, redeem at the cinema - it’s cross-functional magic. Understanding the structure is key to selecting the one that fits your lifestyle best.

Many believe that loyalty points never expire - unfortunately, that’s not always true. In fact, some expire within months if unused, catching casual members off guard. Another widespread misconception is that all rewards are worth pursuing. Not every redemption offers good value; some products or vouchers might cost more in points than they do in real money.

There’s also the myth that you must be a frequent buyer to benefit. While heavy spenders climb tiers faster, savvy light users can still extract considerable value through promotional offers and smart redemptions. Plus, not all loyalty benefits revolve around purchases; some include perks like early access or bonus content simply for staying active.

Finally, people often assume that once enrolled, the programme will automatically work in their favour. In reality, success requires attention - monitoring your balance, understanding the fine print, and being proactive with timing. Passive participation typically leads to wasted potential.

Ever wonder why some people seem glued to their loyalty apps while others never bother? It’s not just about points or freebies - it’s about how those systems tap into our behavioural instincts. Loyalty programmes, at their best, don’t just reward - they create emotional triggers. Think anticipation, satisfaction, even a sense of accomplishment. We’re not just collecting - our brains are being nudged to feel good about doing so.

This dynamic is especially visible in entertainment-based platforms, like online casinos. The line between incentive and impulsiveness can blur quickly. That's why savvy players look for platforms that keep things streamlined and transparent. A casino no verification setup, for instance, removes friction - allowing users to dive into their gameplay and loyalty benefits without getting bogged down in bureaucracy. It’s about access, not just attraction. When trust and ease intersect, participation naturally follows.

The secret sauce? Consistency. Programmes that drip-feed small, achievable wins - whether through micro-bonuses, streak tracking, or gamified dashboards - keep users coming back. Add in a touch of personalisation, and you’ve got more than a scheme. You’ve built a habit. And once something feels like second nature, the loyalty isn’t just to the perks - it’s to the experience itself.

Thinking of joining a rewards programme but unsure where to start? You're not alone. From flashy offers to tiered perks, it can feel overwhelming to pick one that actually delivers. But here’s the secret: the best loyalty scheme isn’t the flashiest - it’s the one that matches how you shop, travel, or spend. This section gives you a practical edge before committing to any programme that might look good on paper but ends up collecting dust.

Joining a loyalty programme should be a strategic move, not a spontaneous one. The first consideration is how well the scheme aligns with your spending habits. If you rarely shop at a brand, collecting its points won't pay off. Frequency of use matters greatly. Equally important is reward accessibility - how easy is it to claim benefits? If redemptions require a labyrinth of conditions, the programme may not be worth your time.

Next, evaluate transparency. A good loyalty scheme makes earning and spending points straightforward. Are the rules easy to understand? Are your balances clearly visible? A lack of clarity often leads to frustration and disengagement. Additionally, look for flexibility. Can you use your points in multiple ways, or are you restricted to limited, predetermined options?

Lastly, consider the brand’s reputation. Does it regularly honour its promises? Have there been complaints about denied redemptions or sudden changes to the terms? A loyalty programme is only as strong as the trust behind it. Choose wisely, and you'll gain consistent value without unnecessary hassle.

Retail loyalty programmes tend to focus on volume - encouraging repeated visits through small, frequent incentives. Supermarkets, coffee shops, and clothing brands often use this approach, giving cashback, vouchers, or free products. Their appeal lies in convenience; you earn while living your normal routine.

Travel programmes, by contrast, operate on high-value, less frequent transactions. Airlines and hotel chains reward loyalty with upgrades, priority treatment, and complimentary services. While points accumulation might be slower, the benefits can be substantial - think first-class flights or five-star stays. Timing and route flexibility often yield greater returns.

Service-based schemes, such as those offered by banks, mobile providers, or fitness clubs, typically bundle loyalty into subscriptions or packages. Instead of collecting points per transaction, customers receive ongoing benefits for continued commitment. Free device upgrades, health perks, or concierge services are common. These programmes shine when you value long-term support over instant gratification.

Multi-brand loyalty schemes offer breadth. They allow you to earn points across several unrelated businesses and pool rewards into one account. The advantage is clear: no matter where you spend - from a bookshop to a beauty salon - you’re constantly accumulating value. Examples include coalition networks that span retail, travel, and dining sectors. This diversity adds robustness to your earning strategy.

However, single-brand programmes often deliver more depth. They’re designed to reward frequent, focused engagement. For instance, a customer regularly shopping at the same store will likely unlock better-tier perks, exclusive deals, or personal attention. Brand-specific apps enhance the experience with real-time updates, tailored suggestions, and direct customer service access.

So, which should you choose? That depends on your lifestyle. If your shopping habits are scattered across various outlets, multi-brand wins. If you're loyal to a single retailer, the focused option will likely yield superior rewards and recognition.

Maximising value from loyalty schemes requires more than passive participation - it demands a systematic, informed approach. While many consumers engage with these programmes at a surface level, the most successful users apply intentional strategies that align with both their spending patterns and programme mechanics. This section explores the tactical methodologies that allow members to leverage accelerated earn rates, tiered progression systems, and partner integrations to achieve optimised outcomes across a variety of loyalty ecosystems.

Not all activities earn points equally. Some offer significantly more returns than others - these are the ones to target. High-margin items, promotional categories, or seasonal bonuses can amplify your earnings. For example, purchasing electronics during a triple-points weekend can yield more value than a month of routine grocery runs.

Signing up for newsletters, completing surveys, or referring friends often earns points with minimal effort. Don’t overlook these. Check your account dashboard for any short-term goals that unlock extra perks. Brands frequently run ‘challenges’ that reward specific actions like trying a new product or using a feature in their app.

It's smart to align your everyday spending with high-reward categories whenever possible. Why pay full price at a non-partner merchant when a partner brand offers the same item plus points? Smart allocation of your budget accelerates your reward journey without increasing total spend.

One of the most overlooked opportunities lies in partner promotions. Loyalty schemes often include affiliated brands or services where you can earn extra points or receive discounts. Whether it's using a specific credit card, booking through a travel portal, or subscribing to an entertainment platform, these partner deals can be golden.

Timing is everything. Partner promotions usually have a limited window. Subscribe to alerts or check regularly to catch them. Stackable promotions are especially valuable. For instance, you could earn loyalty points from a retailer, cashback from your card provider, and a referral bonus - all in one purchase.

Here's a simple table to help illustrate common partner offers across sectors:

| Partner Type | Typical Reward | Example Action |

|---|---|---|

| Airline Hotel | 2x points per night | Book hotel via airline portal |

| Retail Bank | 5% cashback points | Pay using branded credit card |

| Streaming Mobile | Free subscription month | Subscribe via telecom plan |

Climbing tiers unlocks elite rewards. From priority boarding to complimentary upgrades, moving up levels brings tangible improvements. But getting there faster often requires strategic planning. Focus your spending on a single programme during a qualifying period to concentrate your efforts. Big expenses, such as holidays or gifts, should be timed accordingly.

Status matching is a clever shortcut. Many companies will grant equivalent status if you can prove your membership in a competitor’s scheme. For example, show your gold-tier hotel card, and another chain might upgrade you instantly. This tactic works particularly well in travel, where elite benefits can transform your experience.

Additionally, watch for “fast-track” offers. These limited-time promotions allow rapid advancement by completing specific tasks or hitting milestones. They’re an excellent way to leapfrog tiers without months of effort. Combine this with everyday activity, and you’ll scale the ladder in no time.

You’ve earned those points - now what? Managing your loyalty balance and cashing in at the right time makes all the difference between a mediocre deal and a jackpot-level redemption. But it’s not just about saving up and splurging later; there’s a rhythm to getting the most out of every point. This section breaks down smart strategies to not only earn efficiently but also redeem with real impact.

Efficiency is key when it comes to accumulating points. It's not just about spending more - it's about spending smart. Many people miss opportunities because they fail to register their cards or forget to scan their apps during transactions. Ensure every eligible purchase counts by using the right payment methods, enrolling in bonus offers, and linking all relevant accounts. Some loyalty schemes also allow you to earn by completing activities like watching tutorials or providing feedback. These simple actions can quietly boost your balance.

It’s wise to centralise your spending with a few high-reward programmes rather than scattering across many with low returns. Focus on those that offer daily value rather than just once-in-a-blue-moon perks. Make it a habit to review the earning rules - sometimes small changes, like switching to a digital receipt, earn bonus credits.

Lastly, seasonal campaigns can offer double or even triple points. During these periods, stock up on items you regularly use. Just make sure the reward outweighs the cost. Earning points should complement your routine, not complicate it unnecessarily.

It’s a painful moment when you realise your points have vanished due to inactivity. Avoiding this requires attention and proactive behaviour. First, know the expiration rules. Some points lapse after a fixed period, while others only expire if your account goes dormant. In either case, set calendar reminders to act before the deadline.

Engage periodically - make a small purchase, redeem a low-value reward, or interact with the platform. Some programmes allow you to donate a portion of your balance to charity, which both resets the expiry clock and supports a good cause. Even linking your account to an activity tracker or logging into the app might qualify as activity.

Another smart strategy is to use points to buy gift cards or small household items if you see the expiration date approaching. Don't let them waste away. Every point has value, and with careful management, none need slip through your fingers.

Redemption is where the magic happens - but not all rewards offer equal value. The best practice is to calculate the point-per-pound ratio for each option. Some redemptions, such as travel upgrades or high-demand event tickets, provide disproportionately high returns. On the flip side, using points for low-margin goods or overly inflated catalogue items often yields poor value.

It’s also essential to avoid impulse redemptions. Take your time to assess upcoming opportunities. For instance, holding off a few weeks might allow access to a seasonal sale where your points stretch further. Timing your redemptions strategically turns a modest balance into a windfall.

Always double-check any fees or restrictions. Certain rewards come with hidden surcharges, blackout dates, or limited availability. Reading the terms before finalising redemption ensures you extract maximum benefit without disappointment. Knowledge truly is power when navigating reward catalogues.

If you’ve ever wondered how some people seem to fly first class, snag free stays, or never pay full price - without spending a fortune - you’re about to find out. Loyalty veterans have tricks up their sleeves that the average member overlooks. This part dives into the behind-the-scenes strategies used by seasoned pros who squeeze every drop of value out of reward schemes, and shows you how to do the same.

When it comes to redeeming loyalty points, timing is everything. Experts suggest that certain periods - typically during flash sales, off-peak travel seasons, or partner anniversaries - offer the highest redemption value. You might find that flights cost 30% fewer miles in February than in July. The same logic applies to shopping points: holiday clearance events often yield massive savings per point spent.

Many brands announce upcoming offers in advance. Subscribe to updates, and mark your calendar. For large redemptions like hotel stays or electronics, waiting until these windows can make the difference between decent value and exceptional benefit. Timing rewards around gift-giving seasons also amplifies their impact - you save money and delight someone else in the process.

One of the savviest tactics among seasoned reward hunters is double dipping. This means earning points in two programmes for the same transaction. For example, you could book a hotel via a travel site linked to your card and earn both travel points and credit card cashback. It’s a legitimate, easy trick to multiply your rewards with no extra cost.

Cross-programme benefits extend this further. Many loyalty systems are interconnected. A hotel membership might grant airport lounge access. A supermarket scheme could link to a fuel discount programme. By understanding these relationships, you create a web of interlocking perks that magnify each other. It’s all about joining the dots.

Even lesser-known linkages can be rewarding. Did you know that some subscription boxes partner with lifestyle apps? Or that museum memberships sometimes offer airline miles? Keep your eyes open - you never know which collaboration could surprise you.

Technology is your best friend when managing loyalty schemes. Numerous apps consolidate all your programmes into one dashboard, tracking balances, expiry dates, and reward values. These tools also send alerts when special offers or new promotions arise. Some even suggest the best card or retailer to use for each transaction based on current bonuses.

Browser extensions play a valuable role too. As you shop online, they notify you if a site is eligible for points, cashback, or discounts. No more forgetting to activate an offer - it’s automated. Then there are travel apps that search for flights or rooms where your points are most efficiently spent, comparing options in real time.

For data lovers, advanced tools allow you to analyse your reward patterns. Which category earns you the most? When do you redeem most effectively? Insight leads to optimisation. With the right digital companion, loyalty management becomes an empowered, seamless experience.

Not all that glitters is gold when it comes to loyalty schemes. In fact, chasing perks without a clear strategy can lead to overspending, missed deadlines, or wasted potential. Before you go all-in on that next point offer, make sure you’re not falling into one of the common traps that even experienced players sometimes miss. This section highlights the most frequent slip-ups - and how to sidestep them.

The golden rule? Never spend more than you usually would just to earn points. Loyalty is supposed to reward natural behaviour, not drive unnecessary purchases. Yet the lure of reaching a new tier or unlocking a limited-time bonus often tempts users into excess. A £100 purchase to earn 100 points that are worth £1 makes little sense financially.

To avoid this trap, establish a monthly budget and stick to it. If you wouldn’t buy it without the incentive, it probably isn’t worth it with the incentive either. Let loyalty add value to existing expenses, not become the cause of them. Financial discipline trumps reward addiction every time.

Marketers are clever. They craft campaigns to exploit psychological triggers - urgency, scarcity, and fear of missing out. Stay alert. Evaluate deals rationally, not emotionally. The best rewards are the ones that come effortlessly, not the ones that come at a hidden cost.

It’s tedious, yes - but skipping the terms and conditions can lead to costly mistakes. Some loyalty points come with unexpected restrictions. You might need to use them within 90 days of earning, or they could be invalidated if you close an account or miss a required action. Refunds and returns can also affect your balance in surprising ways.

Terms can also include hidden gems. Perhaps you didn’t know you qualify for birthday bonuses, or that combining points with a family member is allowed. Reading the fine print not only protects you from losses but also unlocks hidden advantages. Don’t treat it as legal noise - treat it as a treasure map.

If you find yourself frequently caught off guard, create a simple checklist for each programme you join: expiry rules, redemption methods, and account activity requirements. This keeps you informed without overwhelm and ensures no surprises disrupt your reward journey.

Short-term offers are often the most lucrative. Flash sales, weekend-only bonuses, or event-based campaigns can deliver three to five times the value of regular activity. Yet many users miss them entirely due to a lack of attention. Signing up for email alerts or following brands on social media can keep you in the loop.

Another great habit is checking your loyalty app weekly. Some platforms release rotating deals or time-sensitive challenges that require prompt action. Others include personalised rewards that disappear after a few days. Consistency in monitoring leads to opportunity in accumulation.

FOMO is real - but unlike over-spending, acting quickly on genuine value can yield tremendous benefits. Make it part of your schedule. A five-minute review each Monday might land you an upgraded seat, a free coffee, or access to an exclusive experience you never expected.

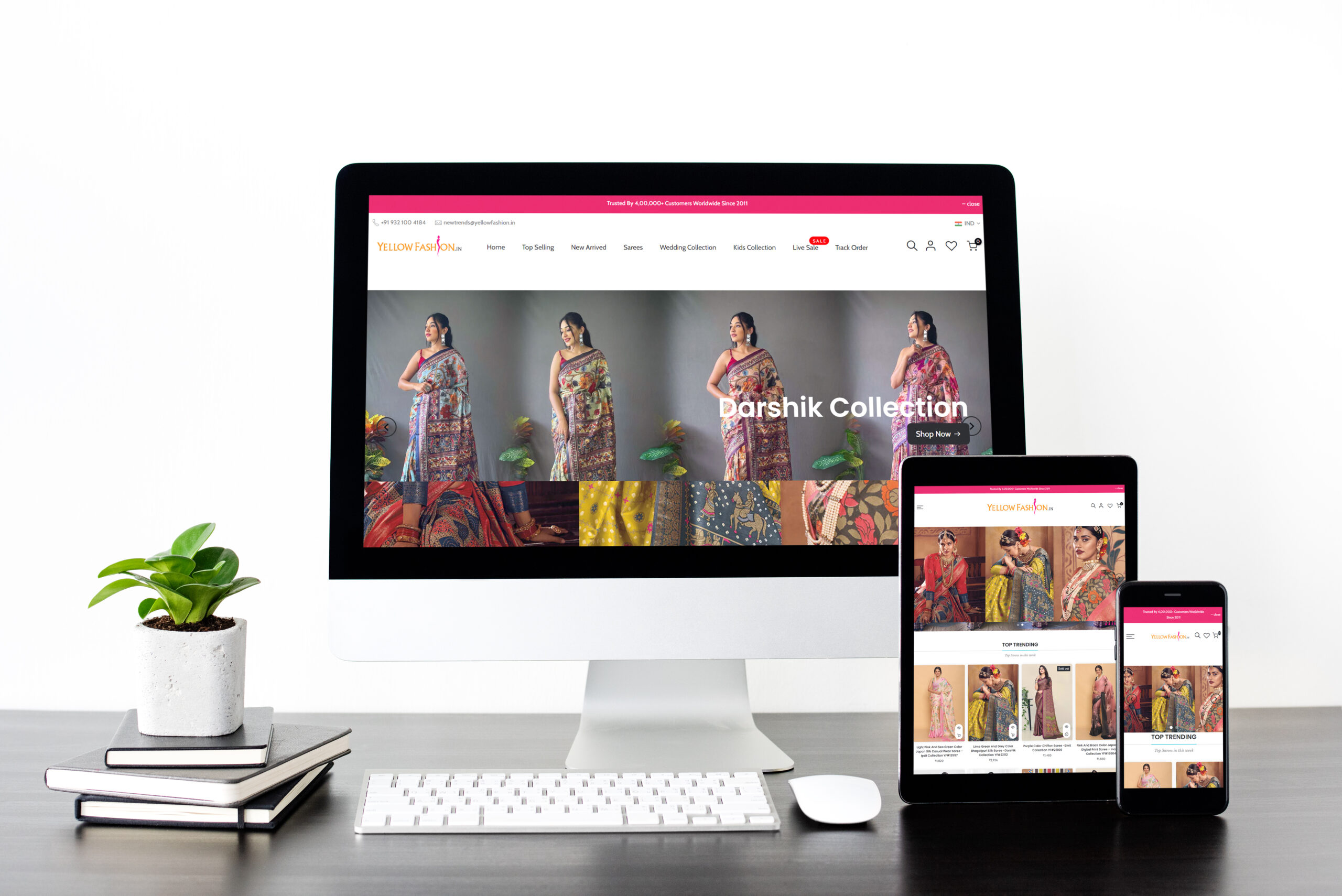

Get Stunning Websites at Half the Price – Plus, a 100% Money-Back Guarantee!

Experience First, Pay Later– Satisfaction Guaranteed!

Get It Now !Note:This offer is only for international clients.